The following will provide links and resources to information relevant to real estate.

Nothing beats solid legal advice from a seasoned real estate attorney that is tailored to your specific needs. Buying, selling or renting real property is a huge step in your financial life. Success or failure can be the difference between a bright or gloomy future. Final note – make sure you understand your rights and obligations before signing anything.

Real Estate laws are specific to the state where the real estate is located (with some exceptions for federal land). Never use document preparers or paralegals to advise you about the complexities of real estate. Only use attorneys who devote the majority of their practice to real estate law.

Important Real Estate Laws

The following link provides information on Arizona real estate law. Arizona real estate law is the body of constitutional, statutory, and administrative rules that govern landlords, tenants, investors, and home buyers in the acquisition, use, and transfer of real estate.

Quick Links to Articles & Links

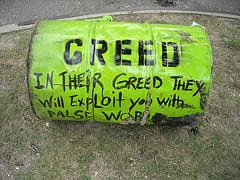

Mortgage Fraud/Foreclosure “Rescue” Scams

Arizona Attorney General’s Office – articles on predatory lending, plus much more

Title 15, Section 1639 – Home Ownership and Equity Protection Law (HOEPA)

Something Every Consumer Should Know About Applying for a Home Loan: Your Name is being sold by the credit bureau.

What is a Beneficiary Deed? by Susan M. Ciupak and Joshua Forest

Who Pays What? A Guide to Closing Costs, by Rose Jones

What is a Deed in Lieu of Foreclosure? Also referred to as a “DIL”.

Foreclosure is sometimes the best option for the lender. When a secured debt on real property is in default, lenders and borrowers (homeowners) have the opportunity to work together to address the default. If the lender and borrower can work together, the simplest alternative may be to let the property go through foreclosure, which will save the borrower time and allow the foreclosure purchaser (perhaps the lender) to take over the property free of all junior liens.

“Deed In Lieu : Merger Doctrine Does Not Apply Where Grantee is Senior Lienholder” by Benzion J Westreich & Scott C Cutrow, Katten Muchin Rosenman LLP

Visit “Deeds in Lieu: Does Merger Apply When Grantee is Senior Lienholder?”

Learn about the Power of Attorney in Arizona by Bob Ciancola, an Arizona attorney practicing in business transactions, tax law and estate planning. (reprinted with author’s permission)

An action to quiet title to real property may proceed where the underlying debt remains unpaid but the statute of limitations for a suit on that debt has expired.

In re Aroca v Tank Investment, CV 24-0049-PR, (Az Court of Appeals, Div 2, 3-31-25) ¶1 The issue before us is whether an action to quiet title to real property may proceed where the underlying debt remains unpaid but the statute of limitations for suit on that debt has expired.

¶2 In 1914, this Court held that equitable principles prohibited a plaintiff from obtaining a quiet title judgment when his mortgage debt remained unpaid. Provident Mut. Bldg.-Loan Ass’n v. Schwertner (“Provident”), 15 Ariz. 517, 518–20 (1914). In 1941, the legislature took a different approach by enacting A.R.S. § 12-1104(B) pertaining to quiet title actions: “If it is proved that the interest or lien or the remedy for enforcement thereof is barred by limitation, . . . plaintiff shall be entitled to judgment barring and forever estopping assertion of the interest or lien in or to or upon the real property adverse to plaintiff.”

¶3 We hold that the equitable principles set forth in Provident do not alter the rights established in § 12-1104(B). An action to quiet title to real property may proceed where the underlying debt remains unpaid but the statute of limitations for suit on that debt has expired.

Searching for someone who cares about their clients?

Take your time and find an attorney who is conscientious, experienced, compassionate, and with whom you have a strong working relationship.

Glossary of Real Estate Terms

On this page you will find a glossary of commonly used terminology used in bankruptcy or in a court setting.

Real Property Laws – Arizona

The following link provides information about Title 33 in Arizona, which includes the laws for landmarks and surveys, estates, landlord & tenant, conveyances & deeds, gifts, mortgages, deeds of trust, liens, homestead & persona property exemption, condominiums, Arizona residential landlord & tenant act, Arizona mobile home parks residential landlord & tenant act, liabilities and duties on property used for education & recreation, due on sale clauses, self-service storage, planned communities, residential rental property, homeowners’ association dwelling actions, recreational vehicle long-term rental space act, timeshare owners’ association & management act, commercial builds telecommunications services, access to private property, private property rights and the uniform commercial real estate receivership act.

visit Arizona Real Property Laws – Title 33 at the azleg.gov website

A beneficiary deed may name multiple grantees who take title as joint tenants with right of survivorship, tenants in common, a husband and wife as community property or as community property with right of survivorship, or any other tenancy recognized by state law. To read more about Beneficiary Deeds 33-405 visit the following link :

When a lender has an interest in a home or other property secured by a deed of trust, they can use a trustee’s sale to secure payment in Arizona. If a borrower falls behind on their payments under a deed of trust, the lender has the authority to begin the foreclosure process. To learn more about trustee sales in the state of Arizona click on the link below:

A judicial foreclosure begins when a lender files a lawsuit in order to obtain a court order allowing a foreclosure sale. If you do not respond with a written response, the lender will win the case automatically. If you choose to defend the foreclosure lawsuit, the evidence will be reviewed by the court, and the winner will be determined. To understand more about Judicial Foreclosure, visit the following link:

NOTE – please do not do agreement for sales or contract for sale without first talking to a competent Arizona real estate attorney.

A residential real estate purchase and sale agreement in Arizona is a legal document that details the terms and conditions of a buyer’s purchase of property from a seller. The agreement’s terms will be negotiated by the seller and buyer (or their attorneys), including the purchase price, closing date, property condition, and so on. Learn more by visiting the below.

Forfeiture of a purchaser’s interest in the property for failure to pay monies due under the contract may be enforced only after the expiration of the following periods after the due date: 1. If less than a quarter of the purchase price has been paid, thirty days. To learn more about forfeiture visit the link below:

A Forcible Entry and Detainer in Arizona is a legal action that a landlord or property owner can take if an existing occupant refuses to leave after being given adequate notice. This occupier could be a tenant or the original owner of a foreclosed or trustee’s sale home. Find out more about Forcible Entry and Detainer in Arizona by visiting the link below:

Forcible Entry and Detainer at the azleg.gov website

Real Estate Links: Agencies, Departments & Organizations

designed for lawyers involved in lending, mortgage brokering, mortgage-backed securities and debt securities. Complete library of downloadable forms and documents, regular news updates, information on mortgage products and services.

Visit eFanniemae to learn more

The nation’s largest source of home-mortgage funds.

visit Fannie Mae to learn more

Visit FEMA – Federal Emergency Management Agency Site. General guide before and after disasters, National Flood Insurance, US Fire Admin, official forms.

Created by Congress, supports home ownership by purchasing mortgages and repackaging them into securities. Useful current and historical prime mortgage rate information, downloadable documents and library of mortgage instruments, organized by state.

Visit Freddiemac to learn more.

Federal Deposit Insurance Corp. federal banking laws and regulations; full text of publications and articles, survey of important federal laws related to banking; statistical reports on banks and banking.

Visit FDIC to learn more.

US Department of Housing and Urban Development resources for home owners and professionals

Visit HUD to find out more about the US Department of Housing and Urban Development.

Arizona Residential Landlord – Tenant

Foreclosure & Trustee Sale – Arizona

Here is an overview and links to information about Trustee Sales & Foreclosure

By Diane L. Drain, Founding Chairperson of the Arizona Trustee’s Association

visit Trustee’s Sale Process

Information on Arizona Trustee Sales, foreclosure and bankruptcy.

In the following article I describe the caveats in investing properties that have been purchased at a trustee’s sale. Read this article that I have written “Friendly Advice When Investing in Property Purchased after a Trustee’s Sale”.

A question many lenders face is what to do when a borrower defaults on a promissory note. Depending on whether the loan is a mortgage or a deed of trust will affect the decision the lender makes, but the main question the lender needs to ask is whether it would be more beneficial to foreclose on the property, taking the property back with a deed in lieu, or sue on the promissory note. Many lenders automatically think they should foreclose, however, in certain circumstances, suing on the note may be the better remedy. This article focuses on some of the advantages and disadvantages of suing on the note instead of foreclosing.

Read more by visiting the following link:

Sue on the Note or Foreclose on the Property – what is the difference? by Stephanie Wilson

This downloadable PDF displays the Arizona Anti-Deficiency process.

Download the flow chart here Arizona Anti-Deficiency Flow Chart

In an earlier article we discussed the potential effect of the “ Arizona Anti-Deficiency Flow Chart ” statutes, which apply under certain circumstances to loans secured by residential dwellings consisting of a single or dual-family structure, on a lot consisting of 2.5 acres or less. Read more by visiting the following link:

Deficiency Actions, Michael T. Denious, Stoops, Denious, Wilson & Murray, PLC

Tax Lien Foreclosures or Sales – Arizona

Below is a link to a document from the Superior Court Law Library. The listings may be used as a general starting point for your research. .

The old adage holds that nothing in life is as sure as death and taxes. If so, then the liens sold as Certificates of Purchase (CPs) each year by the various Arizona county treasurers for delinquent real property taxes should be the surest of the sure. Read more of this article by visiting the following link:

The county auctioned about 14,000 liens at the Feb. 9-12 sale in downtown Phoenix. Although the number of liens sold was virtually unchanged from 2003, the county collected nearly $2 million more this year. Total sales amounted to $17.5 million, compared with $15.78 million in 2003. Read more by visiting the the following to this article:

Tax Lien Sales Winner for County (but not investors), by Mike Fimea, Arizona Business Gazette, February 19, 2004, volume 124

Homeowner Association Issues – Arizona

Forcible Entry and Detainer “FED”

A Forcible Entry and Detainer in Arizona is a legal action that a landlord or property owner can take if an existing occupant refuses to leave after being given adequate notice. This occupier could be a tenant or the original owner of a foreclosed or trustee’s sale home. Find out more about Forcible Entry and Detainer in Arizona by visiting the link below:

Forcible Entry and Detainer at the azleg.gov website

Excess Sale Proceeds (funds left after a foreclosure)

ARIZONA SPECIFIC: Excess sale proceeds are those funds left after an auction of the real estate (either trustee’s sale or foreclosure) These funds are deposited with the Treasurer’s Office, and a complaint is filed in the county where the property was located. Those with valid rights (junior secured lenders, old owners, etc.) can apply for the funds. A commission will review the applications and enter the appropriate orders. NEVER sell your right to collect those funds. Always talk to an experienced Arizona attorney in order to determine your rights. This firm offers a free consultation. If we cannot help you, we will provide some possible referrals to experienced Arizona attorneys.

Find out more about Excess Sale Proceeds in Arizona by visiting the link below:

Excess Proceeds of Sale at the Maricopa County Superior Court’s website

Diane took over my case when my other attorney was disbarred.

“Diane took over my case when my other attorney was disbarred. ” M.W. Diane Drain is consummate professional. She took over my case when my other attorney was disbarred. This meant appearing on my behalf in Federal Court Judge (not just the Trustee) with about one week’s [...]

My wife and I would recommend Diane to anyone who is thinking of filing

"My wife and I would recommend Diane to anyone who is thinking of filing" P.A. Filing for Bankruptcy is a huge decision, yet Diane’s knowledge of the laws from her years of experience make it far less daunting. My wife and I would recommend Diane to anyone who [...]

You were wonderful

"You were wonderful!!" L. You were wonderful – Thank you so much. I am so glad that my son went to your seminar and found you.

Absolutely top notch

"Absolutely top notch" D.W. Absolutely top notch. All my questions were answered. Would definitely recommend this firm to anyone.

Mrs. Drain is very direct and clear

"Mrs. Drain is very direct and clear." Anonymous When my wife and I first considered bankruptcy we contacted one of the TV advertised law firms that specializes in bankruptcy law. On our appointment we met a group of the most inept people I have ever met. It was exactly [...]

What a huge relief to be released from the financial burden

“If you follow everything she says the process is easy and stress free.” J.E. Don’t hesitate, call Diane! Diane has been a huge lifesaver! I reached out to Diane through a Google search when the existing law firm I had started with wasn’t communicating with me. She [...]

Diane and Jay are caring professionals providing exemplary representation

“I found the Law Office of D.L. Drain to be caring professionals providing exemplary representation…” R.B. Disability and subsequent early retirement caused a growing realization of the need to pursue bankruptcy. I started the process of selecting an attorney with fear and trepidation. [...]

Just wanted to share our story so you can share with others that come in

“Just wanted to share our story so you can share with others that come in” K.T. Diane I just wanted to give you an update on us. We filed bk with you representing us about 7 years ago now. Just wanted you to know we are doing [...]

I have a much clearer understanding of my choices and that has made the financial challenges much easier to deal with

I have a much clearer understanding of my choices and that has made the financial challenges much easier to deal with. T.P. Feeling the questionable unease of financial hardship can be one of life’s most serious challenges; not knowing where to turn for information, who to trust, [...]

Diane and Jay did an excellent job

"Diane and Jay did an excellent job" S.K. Diane and Jay did an excellent job and my wife and I could not be happier. She was able to help us keep the assets that were important to our family and answered our questions along the way. Very [...]

avoid bankruptcy mills

"Avoid bankruptcy mills" D. & B. We were extremely pleased with the quality and level of support you and Jay provided. We had shopped around a bit before contacting you and once we did the comparison with other attorneys and bankruptcy “mills” was extremely and significantly positive. [...]

My very sincere and heartfelt thanks

"My very sincere and heartfelt thanks." Anonymous My very sincere and heartfelt thanks. I am so very glad that I came across your site as I was educating myself on the situation and that I didn’t go with the first attorney I spoke to. You made this [...]

Great attorney

"Great attorney" J. I live in Las Vegas and had a legal matter involving bankruptcy. My attorney in Las Vegas informed me that I would need an attorney from Arizona since the claim was filed in Arizona. I knew no one so went online and searched for Arizona attorneys. [...]

Her expertise and guidance are unsurpassed

“Her expertise and guidance are unsurpassed” P.H. Diane and Jay are an impeccable professional team! She explains everything you need to know and puts your heart and mind at ease with her compassion and understanding throughout the filing process. Her expertise and guidance are unsurpassed! [...]

Diane handled a complicated eviction / Lift of Stay on a tenant who filed bankruptcy

“Diane handled a complicated eviction / Lift of Stay on a tenant who filed bankruptcy” B.R. Diane Drain is an expert who gets the job done! We hired Diane Drain to handle a complicated eviction / Lift of Stay on a tenant who filed bankruptcy. Not only [...]

Diane Helped me Maneuver the Process of Bankruptcy Through an Unusual Situation

“You can feel confident in her ability to provide you with any and all answers that may arise. ” D.L. I can’t say enough about the professionalism for Diane Drain and Jay. She helped me maneuver the process of Bankruptcy through an unusual situation. I highly recommend Diane [...]

Diane guided and supported me throughout the challenges of bankruptcy

"Diane guided and supported me throughout the challenges of bankruptcy." April Diane Drain and her staff are exceptionally knowledgeable, professional, and responsive. Diane guided and supported me throughout the challenges of bankruptcy in a very supportive and respectful manner. Diane has earned my trust, recommendation, and highest regard. [...]

To file bk was a very hard decision to have to make

"To file bk was a very hard decision to have to make" A.C. To file bk was a very hard decision to have to make. I felt like a failure. In my early 20’s my husband and I bought a home and financed it using an arm [...]

Another Non-Profit Scheme to Steal Homes

Keeping Kids in their Home Foundation is a scam. “Someone should never deed their house over to anyone without the bank‘s consent. These guys are [...]

Bank of America Penalized $45 M for Wrongful Foreclosure

Bank of America Hit with $45 Million in Punitive Damages for Bankruptcy Stay Violations In re: Sundquist v. Bank of America, NA | Bank of [...]

HSBC sued by NY Attorney General for Violations of Foreclosure laws

NY Attorney General suing HSBC Holdings, PLLC for failure to properly negotiate loan modifications and other foreclosure law violations. “Heads I win, tails you lose” [...]

Flagstar Bank to Pay Homeowners 27.5 Million For Illegal Acts

Flagstar Bank admits to unlawful practices that caused many consumers to lose the homes they were trying to save. "That is wrong and unacceptable." Bully [...]