Published On: July 18, 2017

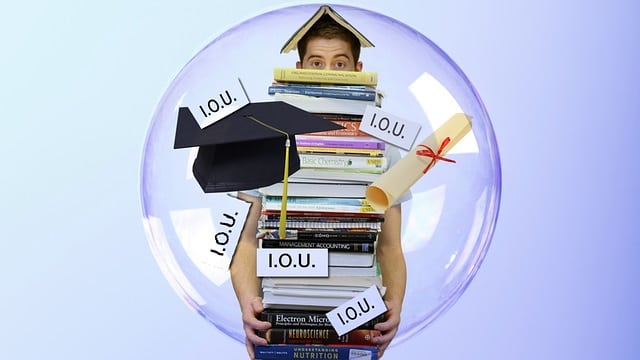

A review of court records show many collection cases are deeply flawed, with incomplete ownership records and mass-produced documentation. Private student loans wiped out – missing paperwork From the New York Times: “Tens of [...]

Published On: July 13, 2017

New policy governing credit reporting criteria. Credit Score can make or break a consumer. Starting July 1, 2017, the three nationwide consumer reporting agencies, Equifax, Experian and TransUnion, are starting a new policy [...]

Published On: July 3, 2017

CREDIT REPAIR SCAMS – COMPANIES SUED FOR CHARGING ILLEGAL FEES AND MISLEADING CONSUMERS Credit repair schemes The Consumer Financial Protection Bureau (CFPB), June 27, 2017, filed two complaints and proposed final judgments in [...]

Published On: June 25, 2017

Study finds domestic violence, ‘coerced debt’ often go together The following is an excerpt from a post by GreenPath regarding an study about the tie between physical abuse and financial abuse, by Susan Ladika/CreditCards.comm 26 [...]

Published On: May 21, 2017

US Supreme Court May 15, 2017: Resolving a split of circuits, the Supreme Court held 5/3 in Midland Funding LLC v. Johnson 6-348 (Sup. Ct. May 15, 2017) that a debt collector who [...]

Published On: May 7, 2017

How to Rebuild Your Credit Feel like you are stuck and cannot find a way out? Are you overwhelmed by financial challenges? Do you want to rebuild your credit? Many people try to [...]

Published On: April 22, 2017

Congress instructed the IRS to use private debt-collectors to collect overdue payments from taxpayers, despite this idea being a complete failure in 1996 and 2006 Debt Collectors abusive shakedown April, 2017 - according [...]

Published On: April 18, 2017

Bank of America Hit with $45 Million in Punitive Damages for Bankruptcy Stay Violations In re: Sundquist v. Bank of America, NA | Bank of America Hit with $45 Million in Punitive Damages for Stay [...]

Published On: April 17, 2017

What is a Judgment Debtor’s Examination The following applies to Arizona lawsuits and collection rights. When a creditor sues and obtains a judgment there are several options available in order to collect on the judgment. [...]

Published On: April 13, 2017

Credit Reports to Exclude Certain Negative Information, Boosting FICO Credit Scores by AnnaMaria Andriotis at The Wall Street Journal As a result of increasing pressure from Consumer Financial Protection Bureau and other regulatory concerns, the [...]

She helped me find resources and gave advice even if she will not be benefiting

She helped me find resources and gave advice even if she will not be benefiting. R.B. Diane Drain is a very kind person. She helped me find resources and gave advice even if she will not be benefiting from the advice. Thank you Diane! [...]

Being of Service to Others certainly overshadowed any money motivation…in the end her expert consultation did not cost us any money.

“Being of Service to Others certainly overshadowed any money motivation…in the end her expert consultation did not cost us any money. ” G.G. Diane was great at coming to our rescue during very stressful times… Dianne and her team were always in good communication and they always [...]

Your fees are extremely reasonable

"Your fees are extremely reasonable!" N. We cannot thank you enough for helping us through this difficult and embarrassing situation. After our first phone conversation I had no doubt you would be able to help us and that you actually cared about our situation. So many larger firms [...]

There will never be a way to repay all you did for us

"There will never be a way to repay all you did for us." J & P I thought lawyers were all greedy. You made sure we could afford your fees which allowed us to keep our car. There will never be a way to repay all you did [...]

The absolute best Bankruptcy Attorney

"The absolute best Bankruptcy Attorney" W.Z. Diane and Jay were wonderful. I really appreciated their genuine compassion. I hired the absolute best for a fair price. Diane has an absolute mastery of the law and she explains everything in a easy to understand style. She will not [...]

Diane helped me retain my dignity

"Diane helped me retain my dignity ." S & A *Diane helped me retain my dignity during a very uncomfortable time. I am very grateful.

Overall grade for help received from Diane and her staff – 110%

"Overall grade for help received from Diane and her staff – 110%" N. Overall grade for help received from Diane and her staff – 110%. Now I can breath and it is thanks to Diane.

If you do your work (make sure everything is accurate) she will do hers and you will have great results

If you do your work (make sure everything is accurate) she will do hers and you will have great results. C & P Diane is a great attorney that made our BK experience as smooth as possible. Before seeing Diane, we went to another attorney who told [...]

You relieved deep seated fears for me…

“You relieved deep seated fears for me…” J.M. You made this terribly difficult situation as comfortable for me as possible. You relieved deep seated fears for me and I felt I was very well taken care of and I felt every area was taken care of completely. [...]

Highly recommend Diane Drain!

“Highly recommend Diane Drain!” J.P. I could not have made a better choice than Diane to help me with my bankruptcy case. During what is a very difficult and stressful time, she made things so easy to understand and the process could not have gone smoother. If [...]

very compassionate and explains everything

"very compassionate and explains everything" J & B.S. It was such a pleasure working with Diane through this difficult process. Diane is a wonderful attorney who not only knows the bankruptcy law inside and out, but is very compassionate and explains everything in detail through each step [...]

Diane and Jay are a wonderful team

"Diane and Jay are a wonderful team!" R & S Diane and Jay are a wonderful team. Efficiency and clarity were the hallmark of our experience.

Her team did a fantastic job taking care of my case

"Her team did a fantastic job taking care of my case" C.C. Diane helped me with my Bankruptcy and it was one the more complicated ones where the trustee asked for quite a bit of information and she and Jay did a fantastic job taking care of [...]

Diane is very compassionate and comforting

"Diane is very compassionate and comforting." Anonymous Diane is very compassionate and comforting. She made a very difficult process much easier for us. Rate Ms. Drain’s services: 5.0 out of 5.0

We were provided affordable comprehensive representation.

“We were provided affordable comprehensive representation.” R.B. I consulted the law office of D.L. Drain expressing our need to file bankruptcy having very limited resources. They accessed our situation and needs; educated us about bankruptcy options and ramifications. We were provided affordable comprehensive [...]

whole process went very smoothly from beginning to end

"whole process went very smoothly from beginning to end." Anonytmous We filed for chapter 7 bankruptcy and the whole process went very smoothly from beginning to end. This was thanks to Ms. Drain who was caring, professional and committed to making sure that we fully understood the bankruptcy [...]

Diane understands that a simple mistake could cost you in many ways

Diane understands that a simple mistake could cost you in many ways. J.D. After choosing to file bankruptcy, I selected another attorney at first, which was a huge mistake. He offered payment plans which seemed to be a good choice at the time. However, his lack of [...]

I am glad that Diane was the person to lead me through it

"I am glad that Diane was the person to lead me through it." T. I wish that I did not have to file for bankruptcy protection; nevertheless, having to go through the process I am glad that Diane was the person to lead me through it. Diane definitely [...]