Published On: August 26, 2013

Keeping Kids in their Home Foundation is a scam. “Someone should never deed their house over to anyone without the bank‘s consent. These guys are predators. It’s just sad and disgusting.” The answer is "yes" [...]

Published On: August 24, 2013

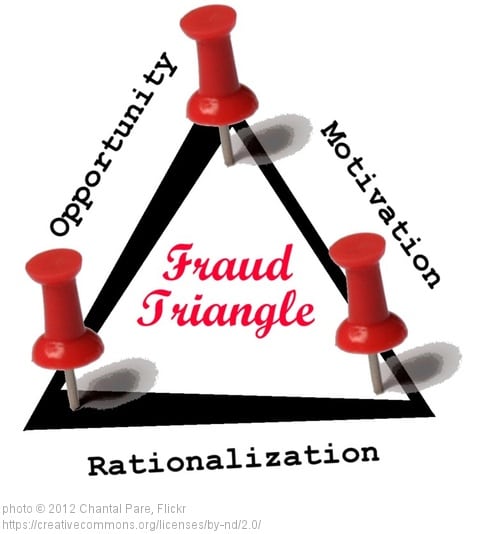

Obama Fraud Task Force investigates JPMorgan Chase & Co.’s for bank fraud related to mortgage backed securities. The answer is "yes" The criminal investigation of JPMorgan Chase & Co.’s mortgage-backed securities practice is evidence a [...]

Published On: August 24, 2013

According to the Federal Trade Commission report nearly 20 percent of consumers had errors in at least one of their credit files. The answer is "yes" Earlier this year the Federal Trade Commission completed a [...]

Published On: August 22, 2013

Rising student loans forcing potential entrepreneurs to abandon their dreams. The answer is "yes" The rising mountain of student loan debt, recently closing in on $1.2 trillion, is forcing some entrepreneurs to abandon startup dreams [...]

Published On: August 22, 2013

The Mortgage Law Group a/k/a Macey Aleman & Searns, a Chicago law firm, agrees to settlement of mortgage fraud scheme. The answer is "yes" Report from the Arizona Attorney General's Office: PHOENIX (Friday, September 07, [...]

Published On: August 19, 2013

Mortgage Modification Fraud: Making All Homes Affordable, LLC, (Phoenix) owner Albert Figueroa, La Paz Source, LLC (Tucson), owners, Maria Beltran and Francisco Ramos, and La Placita Multi Services, LLC, owners Beltran and Arturo Gomez Leon. [...]

Published On: August 19, 2013

The Insidious Virus Circulating Through the Industry’s Blood by Patrick Barnard Short sale fraud and foreclosure fraud continue to grow, impacting mortgage servicers’ bottom lines. Last year, banks lost more than $375 million to short [...]

Published On: August 18, 2013

Seniors need to be very careful about reverse mortgages, warns the Consumer Financial Protection Bureau. Reverse mortgages not being used the way Congress intended. In the summer of 2012 the Consumer Financial Protection Bureau (CFPB) [...]

Published On: June 4, 2013

NY Attorney General suing HSBC Holdings, PLLC for failure to properly negotiate loan modifications and other foreclosure law violations. “Heads I win, tails you lose” is a fraudulent coin toss. Wells Fargo did no better.” [...]

Published On: June 2, 2013

Payday loans and deposit advance loans lead to a cycle of indebtedness; raises Consumer Protection Concerns “Heads I win, tails you lose” is a fraudulent coin toss. Wells Fargo did no better.” The Consumer Financial [...]

Category: Finances

We are a debt relief agency; we help individuals and small businesses through the bankruptcy process. Attorney Advertising. This website is designed for general information only. Any information you obtain from this website should not be construed as legal advice, nor as grounds for forming an attorney-client relationship. You should consult an attorney for information on obtaining formal legal advice.

Privacy Policy | Disclaimer | Sitemap

© Copyright | The Law Office of D.L. Drain, P.A.

Bankruptcy & Foreclosure Attorney servicing the state of Arizona