Published On: September 9, 2013

Millions of Dollars Being Released to Assist Arizona Homeowners Hit by Mortgage Crisis Attorney General’s Office to Expand Mortgage Relief Efforts over Next Three Years Attorney General Tom Horne is today announcing in a press [...]

Published On: September 7, 2013

CFPB announces new rules which provide many protections to consumers, but also offers protection, or "safe harbor," to banks and lenders The answer is "yes" Bully tactics used to scare or coerce buyers. The federal [...]

Published On: August 30, 2013

Lawsuit claims Bank of America that gave bonuses to employees to lie to homeowners and to foreclose on homes. The answer is "yes" Bank of America rewards employees for lying and putting borrowers into [...]

Published On: August 24, 2013

According to the Federal Trade Commission report nearly 20 percent of consumers had errors in at least one of their credit files. The answer is "yes" Earlier this year the Federal Trade Commission completed a [...]

Published On: August 19, 2013

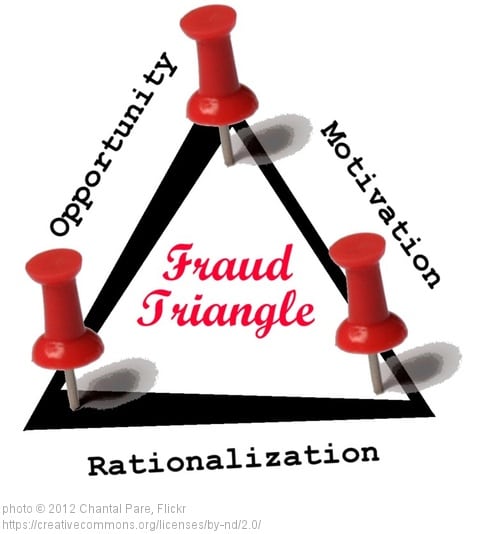

The Insidious Virus Circulating Through the Industry’s Blood by Patrick Barnard Short sale fraud and foreclosure fraud continue to grow, impacting mortgage servicers’ bottom lines. Last year, banks lost more than $375 million to short [...]

Published On: August 18, 2013

Seniors need to be very careful about reverse mortgages, warns the Consumer Financial Protection Bureau. Reverse mortgages not being used the way Congress intended. In the summer of 2012 the Consumer Financial Protection Bureau (CFPB) [...]

Published On: June 4, 2013

NY Attorney General suing HSBC Holdings, PLLC for failure to properly negotiate loan modifications and other foreclosure law violations. “Heads I win, tails you lose” is a fraudulent coin toss. Wells Fargo did no better.” [...]

Published On: June 2, 2013

Payday loans and deposit advance loans lead to a cycle of indebtedness; raises Consumer Protection Concerns “Heads I win, tails you lose” is a fraudulent coin toss. Wells Fargo did no better.” The Consumer Financial [...]

Published On: May 28, 2013

May 19, 2013: banks have paid less than half the $5.7 billion in the 30 different settlements negotiated by various agencies through the Nation. "Heads I win, tails you lose” is a fraudulent coin toss. [...]

Published On: May 28, 2013

Bank Fraud: Wells Fargo, Bank of America, JP Morgan Chase, Ally Financial and Citigroup to pay $25 billion for fraudulent foreclosure practices which led to the worst economic crisis since the Great Depression. In the [...]

To file bk was a very hard decision to have to make

"To file bk was a very hard decision to have to make" A.C. To file bk was a very hard decision to have to make. I felt like a failure. In my early 20’s my husband and I bought a home and financed it using an arm [...]

There were no demons or dragons. It my constitutional right to be free of debt

There were no demons or dragons. It my constitutional right to be free of debt. V.M. I first met Diane in 2009. I was losing control of my finances and therefore my whole life seemed a day to day mix of anxiety and fear. I landed on [...]

You relieved deep seated fears for me…

“You relieved deep seated fears for me…” J.M. You made this terribly difficult situation as comfortable for me as possible. You relieved deep seated fears for me and I felt I was very well taken care of and I felt every area was taken care of completely. [...]

I came to Diane cause her reviews stuck out the most. I WAS NOT DISAPPOINTED!!!

“I came to Diane cause her reviews stuck out the most. I WAS NOT DISAPPOINTED!!!” S.C. I came to Diane cause her reviews stuck out the most. I WAS NOT DISAPPOINTED!!! If you're serious about filing for bankruptcy than I suggest you go with Diane Drain!!! From [...]

Diane and Jay helped out a family member file a bankruptcy.

"Some firms make you feel like a number and just want you to do the bankruptcy that benefits them more. Not Diane." S.E. Diane and Jay helped out a family member file a bankruptcy. They were very easy to work with during a their difficult time. Compassionate and [...]

Diane helped guide me through the bankruptcy every step of the way, with a very calm demeanor

Diane helped guide me through the bankruptcy every step of the way, with a very calm demeanor. D.W. If you have to file bankruptcy, I recommend you hire Diane Drain. After speaking to 3 other bankruptcy attorneys before Diane, I believe I know the difference between a knowledgeable, professional, [...]

Diane uses her website to promote the education of the bankruptcy process available to everyone

“Diane uses her website to promote the education of the bankruptcy process available to everyone” T & G. W. We found ourselves in a financial tsunami 2 yrs ago. No matter how we did things the financial outlook was getting worse and worse. We finally decided we [...]

They helped me through a very difficult time

“They helped me through a very difficult time” P.J. Diane and Jay helped me through a very difficult time. My Husband passed after a year-long had to file chapter 7 bankruptcy, and needed to re-locate to Seattle to live with my daughter and her family. [...]

Absolutely top notch

"Absolutely top notch" D.W. Absolutely top notch. All my questions were answered. Would definitely recommend this firm to anyone.

Diane and Jay were both very helpful and promptly answered questions that came up

"Diane and Jay were both very helpful and promptly answered questions that came up" N.F. Diane and Jay were both very helpful and promptly answered questions that came up either via return phone call, email or both. They both were very knowledgeable about the whole process and [...]

Extremely competent representation and explanations

"Extremely competent representation and explanations!" K.M. 5 Star service and representation from Diane and Jay. Extremely competent representation and explanations of the legal process and how to prepare for the filing. True compassion shown to those going through a very difficult time in their lives. Diane is obviously respected [...]

Diane and Jay are wonderful people that really went to great lengths to help us out

“Diane and Jay are wonderful people that really went to great lengths to help us out” J & T.M. Diane and Jay are wonderful people that really went to great lengths to help us out and manage our bankruptcy in order the give us the best chance [...]

She helped us to pick up the pieces of our lives

"She helped us to pick up the pieces of our lives" Posted on AVVO Anonymous *Diane Drain and her staff have guided us through the rough terrain of a bankruptcy. From the beginning of this process, to an end that is quite near, Ms. Drain has provided the highest [...]

After paying all my bills for 49 years and barely treading water, I was laid off and found myself with nothing

After paying all my bills for 49 years and barely treading water, I was laid off and found myself with nothing. D.W. Like many people, I was very apprehensive about filing bankruptcy. At 65 years old, I always thought- That would never be me! But after paying all my [...]

Her knowledge and ability to ask the right questions enabled myself to have a plan of action

Her knowledge and ability to ask the right questions enabled myself to have a plan of action. L.G. I can’t begin to adequately express how professional, caring and dialed in Ms. Drain was when I consulted with her. Her knowledge and ability to ask the right questions enabled myself [...]

Assisted in identifying and helping me successfully navigate any pitfalls

Assisted in identifying and helping me successfully navigate any pitfalls. R.G. Diane Drain and Jay provided professional, comprehensive services and support through every step of the bankruptcy process, were always available to answer questions. Diane has developed an extensive array of handouts and email templates that addressed [...]

I input the information online and then received timely help from her office when needed.

"I input the information online and then received timely help from her office when needed.." L.H. “When I was looking for a bankruptcy attorney, I visited four large and small firms. Diane Drain was the most informative. I appreciated her very educational website and was prepared with questions when [...]

Mrs. Drain is very direct and clear

"Mrs. Drain is very direct and clear." Anonymous When my wife and I first considered bankruptcy we contacted one of the TV advertised law firms that specializes in bankruptcy law. On our appointment we met a group of the most inept people I have ever met. It was exactly [...]