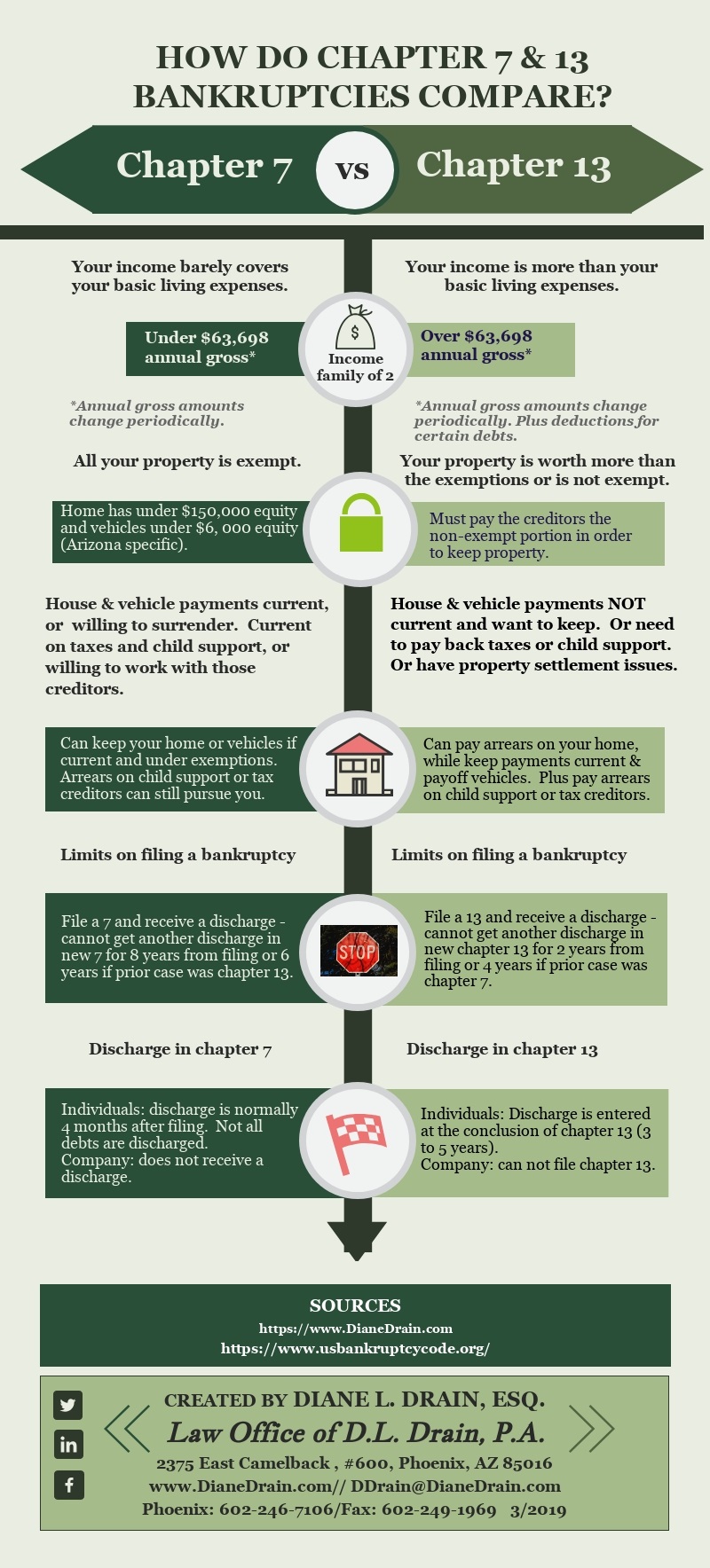

The Difference Between Chapter 7 & 13

Understand the differences between chapter 7 bankruptcy & chapter 13 bankruptcy

Chapter 7 Bankruptcy

With the filing of a chapter 7 bankruptcy, the debtor’s assets and liabilities are effectively frozen.

The debtor preserves the exempt assets, while the bankruptcy trustee liquidates the non-exempt assets and distributes the money to the existing unsecured creditors ( Arizona Exemptions ). The debtor is subsequently discharged (forgiven) the responsibility to pay most existing obligations (such as credit cards and medical bills), and creditors cannot collect the debtor’s future earnings. Lenders with loans on a home or vehicle are either paid in full, paid the current value, or the property is surrendered to the secured lender.

Unless a court order is issued, fully secured creditors will keep their claim on the collateral.

The secured creditor may apply for a court order permitting them to seize the secured collateral (house or car). Fully secured creditors have no right to share in any liquidated asset distributions made by the bankruptcy trustee.

Chapter 13 Bankruptcy

In contrast, a chapter 13 bankruptcy focuses on future income rather than current assets.

The debtor is allowed to keep all of their assets and pay creditors from future earnings. It is very rare that the debtor must pay all their debts as part of a chapter 13 (called a “100% plan). Plan payments are sent monthly to the bankruptcy trustee, who pays the arrears on the property, vehicles, taxes, and child support. If there is money left over, then the trustee pays the existing unsecured creditors, who file proofs of claims. This is achieved through a three- to five-year court-approved plan. The balance of the unpaid obligations contained in the plan are discharged (forgiven) at the end of the plan.

Some debts, such as student loans, survive a chapter 13 bankruptcy.

A few debtors must file chapter 13 because they earn too much money to qualify for a chapter 7. The debtors fill out a form called the ‘means test’ which helps Diane with this analysis. The good news is that a chapter 13 bankruptcy often allows the debtor to save their home, remove certain junior liens on their homes, and pay off their vehicles, perhaps with reduced interest.

There is a debt limit in chapter 13.

As a Law Professor & Bankruptcy Lawyer, I told my students that parts of bankruptcy are magical.

My goal is to educate you about the options and the process from beginning to end. I also help you plan for your future. Our firm is Committed to Quality, not focused on Quantity.