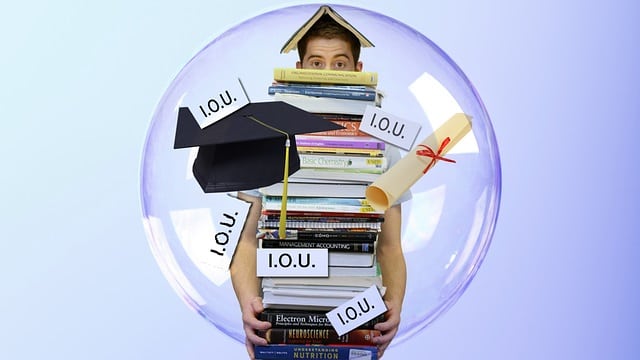

Rising student loans forcing potential entrepreneurs to abandon their dreams.

The answer is “yes”

The rising mountain of student loan debt, recently closing in on $1.2 trillion, is forcing some entrepreneurs to abandon startup dreams and others to radically reshape their business plans, the Wall Street Journal reported yesterday. The average student who borrows has piled up about $40,000 in debt by graduation, including parents’ loans — nearly double the levels of a decade ago, according to Edvisors.com, which runs college-planning and financial-aid websites. Recipients of graduate and professional degrees who borrow carry an average of more than $55,000 in debt at graduation, including undergraduate loans but not parent loans. That is up from $40,800 some 10 years ago.

The rising mountain of student loan debt, recently closing in on $1.2 trillion, is forcing some entrepreneurs to abandon startup dreams and others to radically reshape their business plans, the Wall Street Journal reported yesterday. The average student who borrows has piled up about $40,000 in debt by graduation, including parents’ loans — nearly double the levels of a decade ago, according to Edvisors.com, which runs college-planning and financial-aid websites. Recipients of graduate and professional degrees who borrow carry an average of more than $55,000 in debt at graduation, including undergraduate loans but not parent loans. That is up from $40,800 some 10 years ago.

Some academic experts say that leftover loans are the biggest impediment to upstart entrepreneurship by those who recently received college or graduate degrees. At least one state has taken steps to alleviate the pressures. California this year enacted legislation that will reduce college costs for middle-class Californians who attend its public universities. Similarly, the Rhode Island Student Loan Authority (RISLA), a quasigovernmental nonprofit group, is looking at whether it is feasible to temporarily forbear or reduce payments for recent graduates who start a businesses or go to work for a new venture. The aim is to give recent graduates “the opportunity to try working for a startup or creating a startup instead of having to run off to Arizona and start working for Intel,” says Charles P. Kelley, RISLA executive director.

Click here for the rest of the article….

MUSINGS BY DIANE: “Students and their family are betting on the future when they take out thousands of dollars in student loans. Schools are encouraging everyone to take out student loans regardless of their ability to repay the loan. The schools look at the money as “free”. They raise the tuition so they can charge more which results in increased student loans. The school does not have to offer quality education in order to keep the money. They are not held accountable for false advertising which misleads students into believing the future employment possibilities and income potential. The government is starting (very slowly) to put policies in place to hold schools accountable. Students are starting to hold schools accountable by suing alleging ‘false advertisement, etc’.

Moral – this money is far from “free”. Apply for the funds wisely and take as little as possible. Otherwise, you are betting the peace and stability of you and your family’s future. “

Diane is a well respected Arizona bankruptcy and foreclosure attorney. As a retired law professor, she believes in offering everyone, not just her clients, advice about bankruptcy and Arizona foreclosure laws. Diane is also a mentor to hundreds of Arizona attorneys.

*Important Note from Diane: Everything on this web site is offered for educational purposes only and not intended to provide legal advice, nor create an attorney client relationship between you, me, or the author of any article. Information in this web site should not be used as a substitute for competent legal advice from an attorney familiar with your personal circumstances and licensed to practice law in your state. Make sure to check out their reviews.*

In Case You Missed It

Published On: March 31, 2024

Into the Shadows: Unraveling the Dark World of Fraud, Schemes, and Scams The Sneaky World of Fraud and Scams: How They Work and Why You Should Be Careful Fraud and [...]

Published On: March 30, 2024

After 100 Years of Protecting Homeowners, Arizona's Law Changes to Give Creditors New Rights to Take Your Home Depending on the value of your home, creditors can now take it if [...]

Published On: March 24, 2024

Bankruptcy is a complex process that can have significant implications for your business and personal finances. Before considering business bankruptcy as an option for your struggling business, it's crucial to understand the potential pitfalls [...]

Published On: March 8, 2024

In today's consumer landscape, credit cards are the normal tools for managing finances and making purchases. However, having credit card debt can lead to financial stress and vulnerability to predatory schemes. Recognizing the importance [...]